| HOME |

|

ABOUT THE AUTHOR |

|

|

|

WHERE TO BUY |

Object and liability components of money Part I.

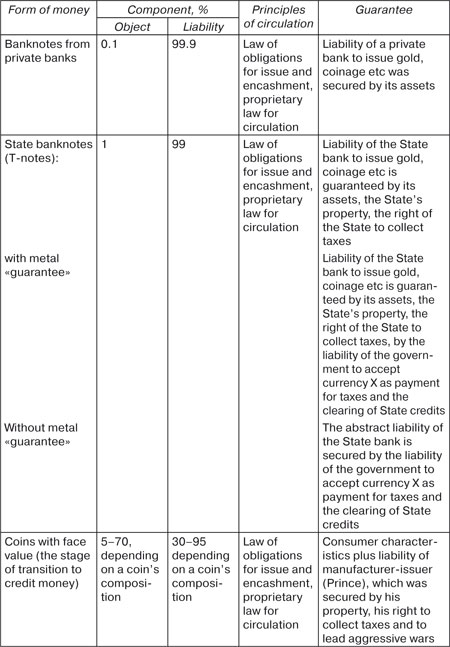

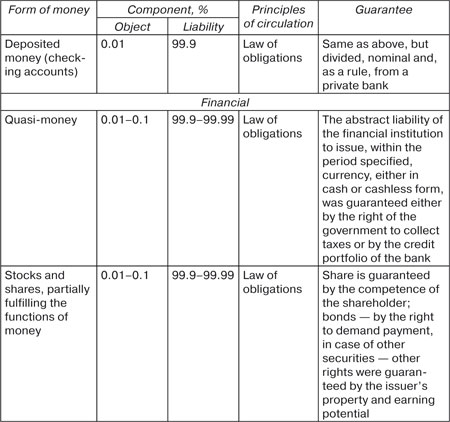

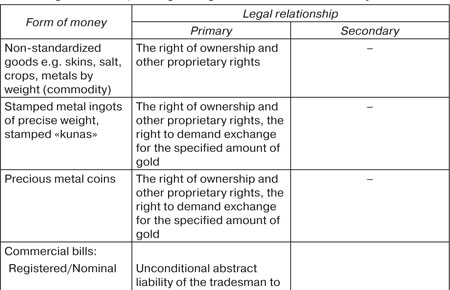

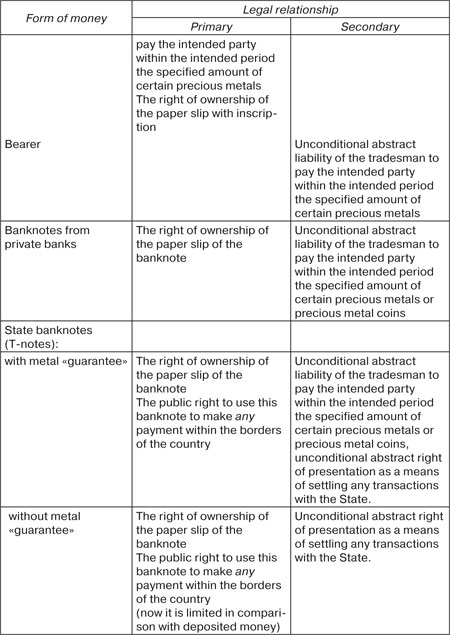

Part IV. The physical properties of money do not appear as essential. Money

does not have common physical properties, and some types of money

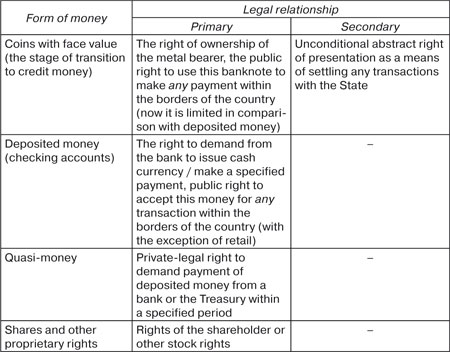

do not even have a material form. (table 7) Object and liability components of different money forms

Yu. Maltsev and I. Shkarinov write: «The legislator calls money an

object only because of the convenience and expediency of regulating the

legal relations linked to owning and managing money in accordance with

proprietary law, although in essence these relations are ones of obligatory/

liability nature. "... The consumer value of money lies in the fact that it serves as a

general equivalent, mediating the exchange of all other property. Its

economic character of general equivalent has not yet been reflected by

the law and is the cause of misunderstandings, which the formation of

purely legal constructions leads us to… In fact, insofar as it is impossible

to effectively apply methods of defence (vindicatory and negatory

lawsuits), characteristic of the law of estate/proprietary law, to the

demand for cash, then the status of money as some sort of material

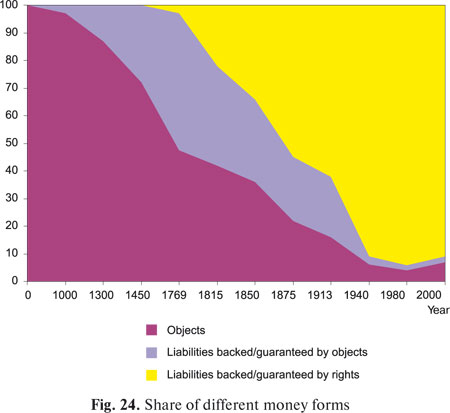

object loses its meaning177 Having analysed the forms of money, we obtain a graph of their

proportional prevalence at different times (fig. 24). Legal relations, arising during the use of different money forms    From fig. 24, we can conclude that, with the development of civil

and industrial relations, the demand for exchange value of money is

higher than for its direct consumer value. However, during an industrial crisis and the resulting crisis of public

confidence in the national currency, a reverse process takes place, when

all those involved in the circulation of goods, expecting to go completely

bankrupt, try to convert exchange value into consumer value.

In this way, a society’s turning away from one form of money during a

time of crisis bears witness to the fact that this type of money has lost

the function of money and therefore is being ousted from monetary

circulation. Up until the crisis it was regarded as money, but during and

after the crisis it is simply no longer accepted.  However, in case of normal development, the object component/

value of different forms of money strives towards zero, since an improvement in the circulation of money leads to reducing representation

of liability information in object form. We can illustrate this with the

following example.. In Ancient Babylon liabilities (promissory notes) were written on

stone tablets weighing up to a kilogram, in Ancient Rome they were

written on clay tablets weighing up to 300 grams. After that the bearer

of such information became a parchment with a weight of 100 grams,

from the fifteenth century onwards it became paper (10g) and nowadays

the information is carried nearly everywhere on electronic bearers,

where one liability occupies approximately 100 thousand molecules of

silicon: much less than 1 mg. Bill Gates’ development of electronic

technology and «the reduction of the co-efficient of information

friction" 178 with the creation of the quantum computer will reduce the

electronic bearer to between 10 and 100 atoms. Now the value of a product is fully separated from its physical form

and appears in a distinct, public form, without the need to be attached

to some or other type of material commodity body. It represents a public

symbol of a physical commodity and functions in the same vein,

relying only on public guarantee. Its value now is expressed simply by

a number, confidence in which is confirmed by the agreement of separate

parties, and also by the agreement of the public and the government.

The latter guarantees this confidence in the name of the public

and on the basis of the power invested in it by the people, by means of

the corresponding legislation and established procedures. |

Copying information from this website is only allowed under condition of referring to this web link.

Copyright © 2008 Andrey Gribov

All rights reserved