| HOME |

|

ABOUT THE AUTHOR |

|

|

|

WHERE TO BUY |

Liability nature of cash currency Part I. Part III.

Part IV. It is easy to see that at the present stage of economic development

the term «currency» refers not to an object as such, which has certain

consumer value, but to an abstract formal obligation of a country’s

Central Bank, which only has certain exchange value, created by the

demand for currency to pay taxes147

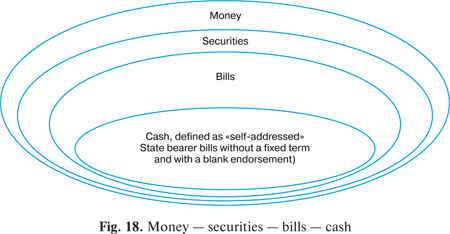

Money in the form of currency is a particular variety of a bill, which,

in its turn, is a security (Article 143 of the Civil Code of the Russian

Federation). Further on, when we use the term «currency», let us consider

the fact that it is a security (fig. 18)..

Sir John Richard Hicks in his classic work «Value and Capital» observed

that: «A security of any sort, which brings in a fixed interest… is

a promise to pay a certain sum of money in the future. However, there

are certain types of documents, which contain an obligation, the documents

that aren’t usually referred to as securities, but considered to

be money itself, though the same classification applies to them. Bank

deposits, at present usually referred to as money, are a promise to pay

money in the future; even banknotes are a promise to pay money. Such

nature of banknotes doesn’t require any explanations and is perceptible

to common sense in cases when banknotes represent a promise to pay

certain… money (gold or bank bills of some other bank superior in

influence to the given bank). However, if superior money disappears

from circulation, a paradoxical situation arises. And this paradoxicality

reflects the very essence of the problem, it is definitely not incidental.

It is a blessing — to have a constant reminder about this paradox in

the form of the inscription on the one-pound banknote: “The Bank of

England promises to pay the bearer on demand the sum of one pound

sterling”148

On pound sterling banknotes it is legibly written: «Bank of England.

I promise to pay the bearer on demand the sum of…». This is followed by

a signature of the of the Chief Cashier of the Bank of England. By its

form and content this is a State bearer promissory note with an «upon

presentation» term.

On USA banknotes, there is no direct promise, but signatures of the

Treasurer and the US Secretary of the Treasury are present. However,

on old American banknotes, for example on Greenbacks of 1862, there

is an inscription: «will pay the bearer on demand".

On 10-dollar Canadian banknotes dating back to 1906 it is also inscribed:

«will pay the bearer on demand".

On Scottish banknotes of 177 is was written that: «Royal Bank of

Scotland hereby obliged to pay the bearer on demand … by order of the

court of Directors…".

Old Russian banknotes leave no doubt as to their nature: on banknotes

between 1779 and 1830 was written: «St. Petersburg Bank pays

the bearer of this government assignat (author’s bold — A.G.) …in

rouble currency, in the year of…» The year of the currency was even

shown, insofar as the content of precious metals in it changed depending

on the year of minting151 On the 1779 banknote the four signatures

(of the two senators, the chief director of the board of banks and the director of the local bank) only appeared handwritten and only in

ink152

From 1840, the word «pays» was replaced by the word «issues".

On the reverse of banknotes of the period between 1855 and 1872,

the following excerpts were printed from the High Manifesto: «Government

credit notes are provided for (author’s bold — A.G.) by all of the

State’s property and by exchange, unceasing at any time, for coin currency

from the predetermined fund".153

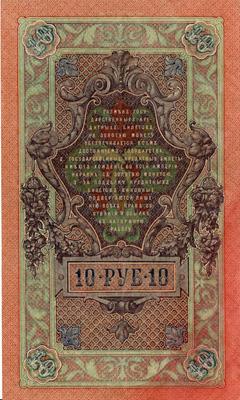

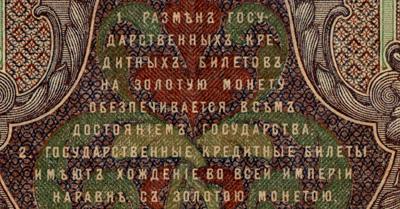

On «tenners» in 1909, the front of the banknote bore the inscription: "The State Bank exchanges credit notes (author’s bold — A.G.) for gold

coins without a limit on the sum (1 rouble = 1/15 of an imperial, contains

17.424 parts of pure gold)".On the reverse of the banknote was inscribed:

«The exchange of government credit notes for gold currency is

secured by all of the State’s property. Government credit bills are valid

throughout the Empire, on a par with gold coins".

It was even written on Soviet banknotes, up to 1991, that they were

secured by the gold reserves of the country or "all of the Republic’s

property", and the Bolsheviks themselves in 1921 issued currency in 1.5 and 10 billion rouble notes called "Obligations of the R.S.F.S.R.".155 In

1924 "Payment Liabilities" 156 were issued.

The direct indication either to a liability, or to a security demonstrates

to us the liability character of paper money.

The judicial system’s mixture of property and other (mainly obligatory)

rights in Russia today can in many ways be explained by the influence

of Anglo-American legal concepts. In this system of law it is accepted

to differentiate «things in possession» (choses in possession) i.e.

things which can be physically possessed, and «things in demand»

(choses in action), i.e. various rights (which in turn can be regarded as

a literal interpretation of the phrase «intangible assets» — res incorporales,

from Roman civil law). However in the European, continental

legal system, the regime of property and the regime of rights are clearly

differentiated. Thus, Art. 90 of the German Civil Code directly decrees

that only «tangible objects» can be things.

Whilst investigating the current, tangible make-up of paper money,

it is possible to introduce an interesting example. In the USA a certain

Tari Steward founded the American Bank Note Company, which produced

notes called «Million dollar bill». These notes were manufactured

using the identical paper as original American dollars, and had an

identical design. However, when it comes to their sale, it is immediately

made clear that these are not genuine American currency and that

they are not suitable for circulation. They are sold as «great presents for

family and friends». On the reverse of these notes was decreed «This

certificate is guaranteed only by belief in the American dream".157

The exchange rate of government liabilities for goods and services

lies behind the value of the real banknotes, an expression of the liability

of the government. The value of any monetary unit depends on its

buying power158. The Harvard University professor H.G. Mankiw defines

the value of money as being the amount of goods and services which

can be bought with one monetary unit.159 If an identical object is not

secured by the State, it is only worth the sum of its tangible constituent parts, which is defined by T. Steward, including the additional cost, as

8 US Dollars.

In addition to this it is definitely necessary to note that the overwhelming

part of such tangible components of real money is created

purely as a defence against forgery and falsification of the liability it

expresses and documents. If paper money were not forged this part

would be considerably less important.

"In all its abstractness, paper money is «cash in hand» in the sense

that it is a visible and tangible material".160

A thing possessing natural, useful properties, when divided into two

parts, divides its use value. If we take a blank sheet of paper, having as

its useful characteristic the possibility of entering onto it a volume of

information, and divide it in half, then the use value of the two separate

pieces of paper will be approximately half as much. However, if we were

to tear a Bank of Russia 10 rouble note in half, it would be an entirely

different story. The half without the serial number would not be worth

anything, and the other half (with the number) would still have a use

value of 10 roubles. Why? Because everyone knows that the Central

Bank of the Russian Federation accepts — at their face value — ancient,

torn or even charred bank notes if the corresponding serial number is

still preserved on them. This example clearly shows that it is necessary

for the bank-issuer, when accepting its credits at face value, at least to

compare this data with the corresponding serial number of said note in

the section «Emissions of money» of the passive part of its balance. Old

banknotes are withdrawn from circulation and destroyed by the Central

Bank, and the sum total of the Central Bank’s obligations, shown in

the «Emissions of money» section, is decreased by the sum total of the

destroyed banknotes’ face value.".

Moreover, the word «emission» itself emphasises the obligatory

nature of paper money.

The monetary reform in Russia in 1991 is a very interesting example.

One «glorious» day, the then Prime Minister Pavlov declared all 50 and

100 rouble notes invalid. On this day, the value of the liability expressed

on these notes became equal to zero. These banknotes really just became

mere things, and their value became equal to the value of the paper, ink and typographic services used to produce them. Some of the

people who did not manage to exchange their banknotes for the new

ones used them to paper the walls of their flats.

Moreover, Article 30 of the Federal Law No. 86-FL «On the Central

Bank of the Russian Federation (The Bank of Russia)», of 10th June

2002, states: "Banknotes and coins are unconditional liabilities of the

Bank of Russia and are secured by all its assets. (author’s bold — A.G.)

Banknotes and coins of the Bank of Russia must by law be accepted at

their nominal value for all types of payment, for depositing into an account,

for investments and for transfer across the whole territory of the

Russian Federation."

The issuer itself decrees directly and unequivocally that its banknotes

are a legal liability. So why does the government of the Russian Federation

not want to acknowledge such an obvious fact?

By the way, speaking of coins, the given norm clearly decrees that

coinage of the Russian Federation is also a liability of the Bank of Russia.

In defining its status it is possible to conclude that coinage, like

banknotes, is a State self-addressed bearer bill valid upon presentation

with a blank endorsement. The only difference between coinage and

banknotes with the same face value is the liability’s material bearer.

Banknotes and coins with the same nominal value clearly demonstrate

a unity of content whilst the form varies.

Later the law describes in detail precisely the obligatory character

of money:

"Article 31. Banknotes and coinage of the Bank of Russia cannot be

declared void (as having lost power as a legal means of payment), if a

sufficiently long transition period is not established to exchange them

for the new banknotes and coins. No limitations of any kind in relation

to the sum or subject of exchange are permitted.

During the exchange of banknotes and coinage of the Bank of Russia

for the new form of tender, the period of withdrawal of banknotes

from circulation must be no less than one year, but must not exceed five

years.

Article 32. The Bank of Russia exchanges old worn out banknotes

without any limitations (author’s bold — A.G.), in accordance with its

established rules.

Article 33. The Board of Directors makes the decision about the

release into circulation of new banknotes and coinage and about the

withdrawal of the old ones, sets the nominal values and forms of the new

tender. A description of the new tender is released to the public via the

media."

Article 4 of this law states: «The Bank of Russia…alone exists as issuer

of cash money and organises the circulation of cash.".

And yet again the very concept of «issue» indicates the obligatory

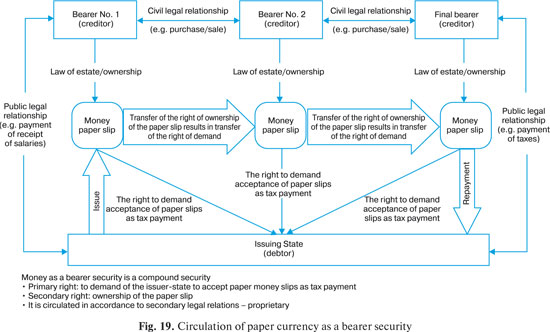

character of money. It is not possible to issue tangible objects (fig. 19).

|

Copying information from this website is only allowed under condition of referring to this web link.

Copyright © 2008 Andrey Gribov

All rights reserved